How to Clean Up Old Uncleared Transactions in QuickBooks Online

Apr 17, 2023Every month, when you reconcile your bank and credit card accounts in QuickBooks Online, there is an important part of the process many people miss.

You’ve just finished confirming everything in your books that cleared the bank or credit card account.

The temptation is to think that the job is done, because you checked everything off that cleared and you balanced with $0.00 difference.

Did you notice the items that you DIDN’T check off?

These should be recent items that you would not expect to clear until the following month. The reality is that, in 2023, there should be very few of these. If you print checks, you might have some uncleared checks, because people haven’t cashed them yet. Most of us are paying things more securely and digitally, and most payments clear within three-to-five business days of when they are initiated.

In reality, there should be almost no uncleared items at the end of the reconciliation process. This means that when there are uncleared items, it should command your attention.

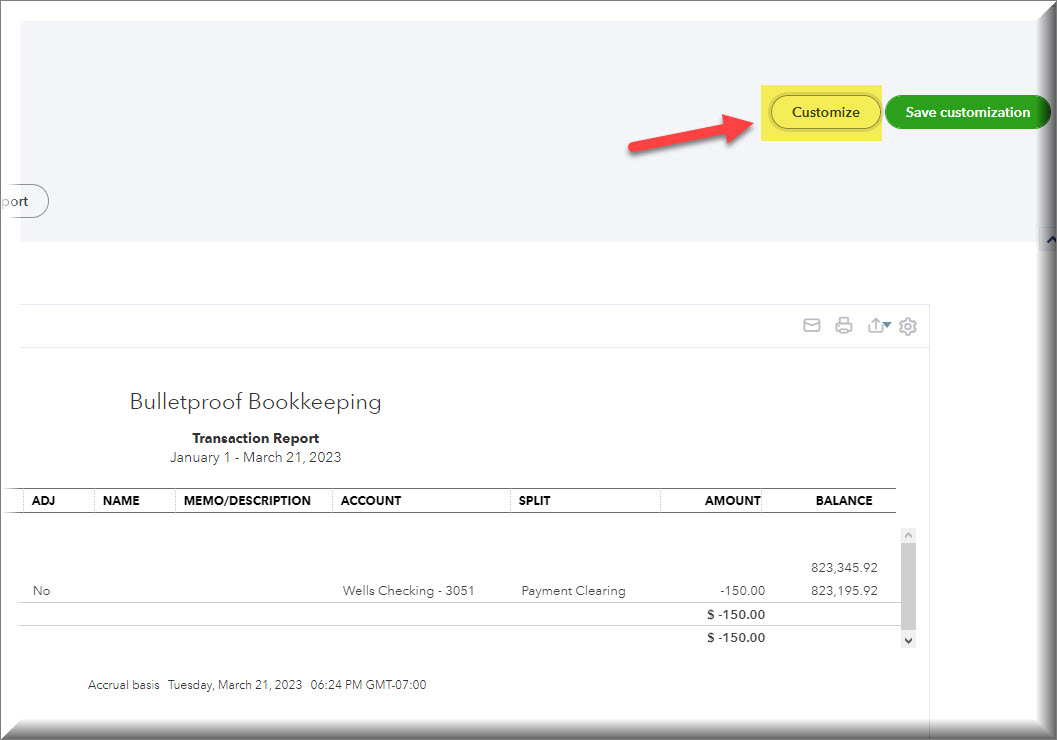

The process for checking this in QuickBooks Online is really simple.

Run your balance sheet.

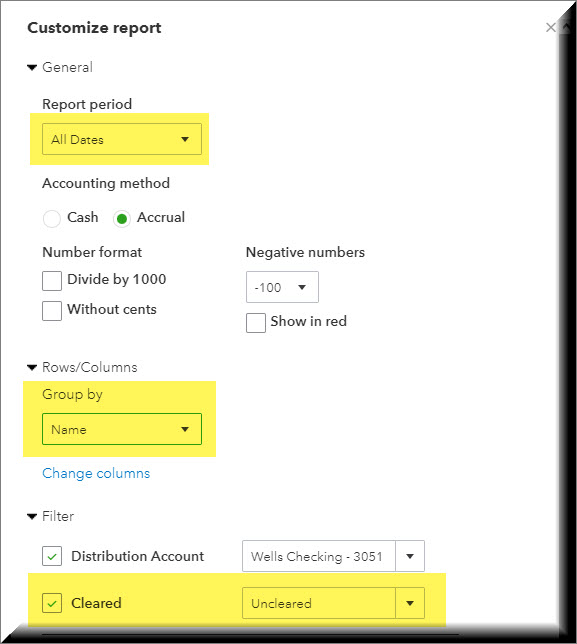

Click into the bank or credit card account balance from the balance sheet to get a transaction detail report.

Next, you want to filter it for uncleared items.

You want All Dates so you can see absolutely everything that meets the rest of the criteria.

I recommend you group by name here. I’ll explain why below.

The Distribution Account will be whichever account you drilled into.

Most importantly, you want to filter the cleared status to show only uncleared.

Then, further down, click Run Report.

You might want to save this configuration, because you should check this every month as the next step after you finish reconciling.

Then you want to analyze what is in this report.

If there are just a few transactions from right around the end of the month, you can pass on the review. Nothing to worry about.

When there is older stuff in there, the question is, “shouldn’t it have cleared by now?”

One of the most common reasons why things show up and stay here in Uncleared is that they are duplicates. This is the first thing I check for. The same transaction was booked and checked off on time in a prior reconciliation, leaving the duplicate outstanding.

This is obviously an easy fix. Just void the transaction, as long as it is in the current year.

If you need to reverse a transaction from a previous year, you can’t void or delete it, because that will throw off the books from their tax return. In this case, you book an offsetting entry in the current year.

If it’s a deposit you need to clear out, you book an expense in the current year, and book it to the same account that the deposit was booked to.

If the deposit contained a payment from a customer, then you have to consider if you ever did get that payment. If not, then you post the expense to accounts receivable, putting the balance back on the books, and reversing the deposit that never cleared.

If the customer payment in the deposit was a duplicate, the duplicate is likely booked directly to an income account, instead of as a customer payment. In this case, you would write the expense to that income account. This is the correct treatment, because the deposit effectively overstated income in the prior year.

You have to look at each item in this uncleared transactions report and figure out, case by case, what needs to be done to reverse it.

If this were a real report and situation, of course I would be very concerned about why there are so many transactions that are this old and unreconciled.

I’ll break down the first one to give you the process for how to go through each of these.

We have an expense to JetBlue Airlines for $750 from 4/1/19.

The first thing I would do is go into the register for Wells 3051 and filter the register for the transaction date, plus and minus five days. So from March 25 to April 5, 2019.

I’m looking for a duplicate. Oftentimes what this means is that the transaction was recorded twice. One of them was reconciled and the other duplicate went unnoticed. This also means that on every subsequent reconciliation, no one bothered to look at the old uncleared items and question why something so old was sitting there uncleared.

If it was a duplicate, you cannot simply void or delete it, because by now it is in a closed period. Instead book a deposit dated 1/1/23 for $750.00 against Travel and Transportation, and put a clear memo explaining that this is to reverse a duplicate expense from 4/1/19. Since this is QBO, you can (and I would) link to the transaction. Even though QBO won’t render it as a hyperlink (I hope they fix this one day) you can still copy and paste the URL.

If it had not been a duplicate, then I would want to pull up that statement, preferably in a .CSV or Excel format and check to see if this transaction cleared the bank. Given it’s from the 19th and something like this should have cleared within a day or two, if it did not clear that statement then it is safe to say it never cleared. You would fix it the same way.

If you find that it DID clear, and there is no duplicate, then you have bigger problems, as in, “how did this reconcile?” A review of that month’s reconciliation report should reveal that. Then you’ll know how to fix it and there will likely be a bit of whack a mole going on, because if it cleared the statement, but not the bank rec, then something else (or somethings) had to be cleared in this transaction’s stead!

If you want the books to be bulletproof, then you’ll need to untangle and reconstruct the bookkeeping so that everything can be verified as it ties to the bank statement. A bank statement is a third party document, which makes it a reliable source of audit evidence.

Then you’ll go through this process for every other transaction in the above report that should have been cleared by now.

If you do this once by way of catch up, and then perform this review as part of the bank rec process every month, you will never have such a mess on your hands again. And since you will be dealing with current transactions, you can simply correct them instead of posting offsetting entries.

READY FOR BLAST OFF?

Hop On 'Nerd's Guide to the Galaxy' and Experience the Ultimate in FREE Coaching, Resources and Training...

- Live workshops, trainings and recordings

- An intimate community of like-minded people

- A FREE course (and you choose your interest)

- Preferred access to my inner circle

- A Free subscription to my newsletter "Nerd's Words"

- Blog Post Notifications

- And MUCH MORE!

We hate SPAM. We will never sell your information, for any reason.