How to Record Income + Sales Tax From a Prior Period In QuickBooks Online

Nov 03, 2022It happens! It happened to my client not long ago in a galaxy not so far away! He held an event outdoors and collected a bunch of cash for merchandise they sold. They kept good records, but completely forgot to share them with us so we could record everything and pay the sales taxes. And now that period has closed and the sales tax return has been filed. Meanwhile the money was deposited back in that period and it was sitting in uncategorized income (not subject to sales tax).

Here’s how to record the income and the sales ta from a prior period in QuickBooks Online.

First we have to deal with the deposit(s) from when we received the money in the original quarter.

Let’s say we received $10,000 in proceeds back in March (it’s now August).

We’re going to change the account from the deposit(s) to a deferred income account (eg) Unearned Revenue.

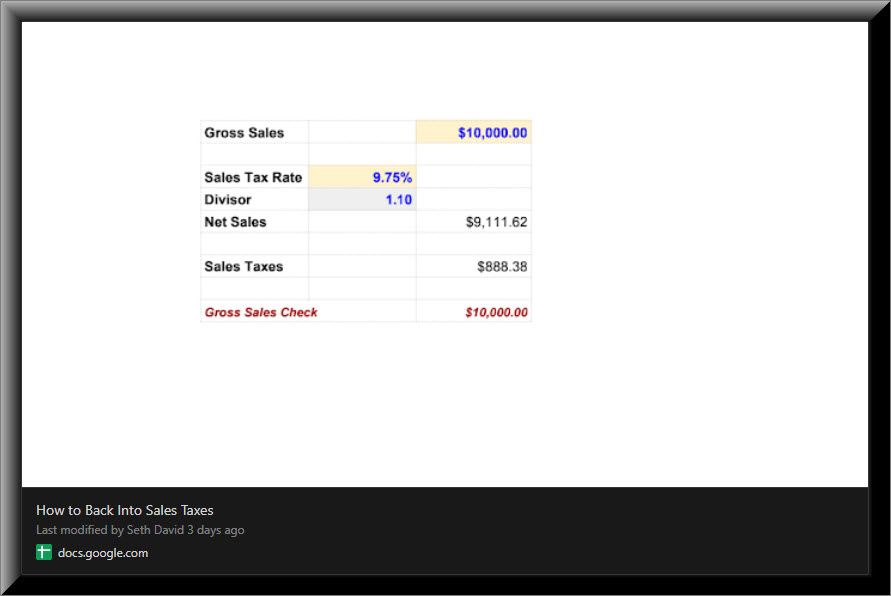

Then we will record the sales in the current period, but first since we know we collected a nice even number of $10,000, we know that includes the sales tax. So we have to back out the Sales amount before tax. To do this I’ve created a simple template. You will need to look up the sales tax rate in the location where these sales were made.

Let’s say the sales tax rate is 9.75%.

You can’t multiply that by $10,000 because that assumes that the $10,000 is BEFORE sales tax. But it’s not. It INCLUDES sales tax. So we need to use a little bit of algebra (remember that stuff and remember when you asked if it would ever be useful in real life?)

Fear not. I’ve done the work for you by applying my mad genius spreadsheet skills.

Here it is in Google Sheets:

Click the template to open it in your browser.

The Click File, Make a Copy and it’s yours, absolutely free!

And if you act now I’ll throw in a free set of steak knives 🔪🔪🔪

Now we can record a sales receipt to capture the income and the sales taxes.

- The sales receipt date is in the current period

- I am depositing this into my sales clearing account. This is a bank account I’ve set up for exactly this kind of thing. Next we’ll clear the sales clearing account against the unearned revenue.

- I have an item linked to an income account for product sales

- For the purposes of this example I created a custom sales tax rate. If you are using the correct rate based on your location, and you used the same rate in the template above, this should come out perfectly.

- That is ME, very happy with love in my eyes because everything balances perfectly. It’s Bulletproof!!

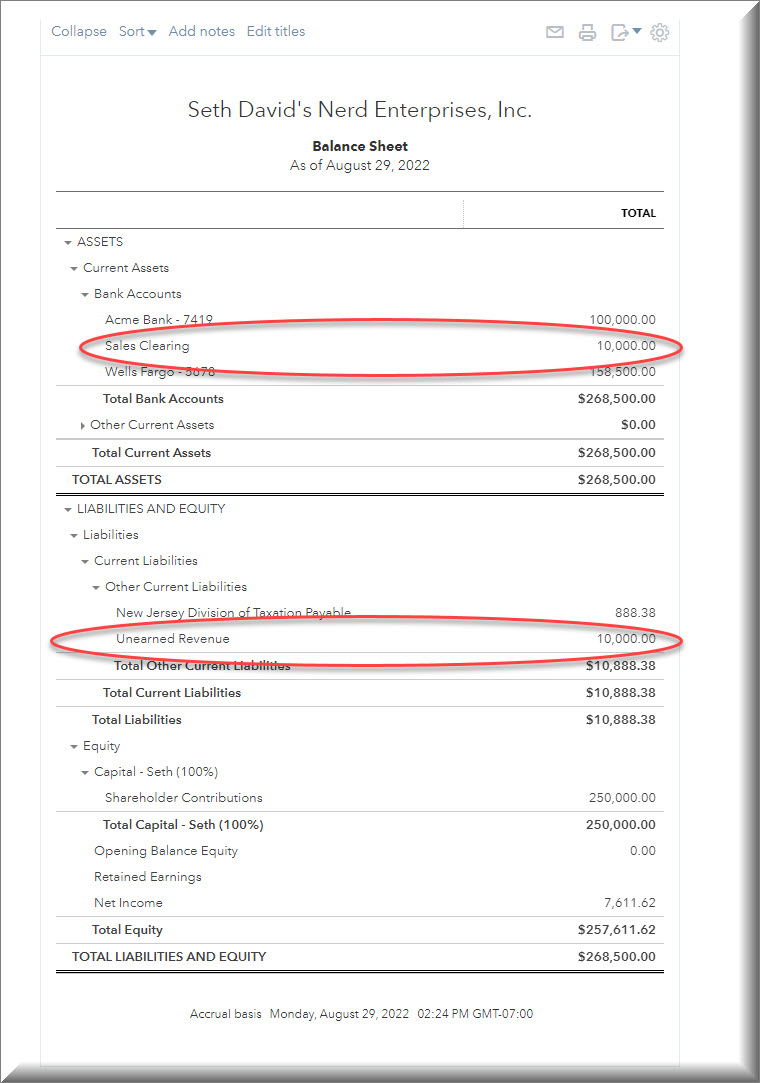

Let’s look at the Balance Sheet now.

Notice we have an asset in the sales clearing account for $10,000 and Unearned Revenue (Liability) for $10,000. These will clear out nicely. The beauty of having the clearing account set up as a bank account is that it’s easy to post the next entry without bothering with Journal Entries.

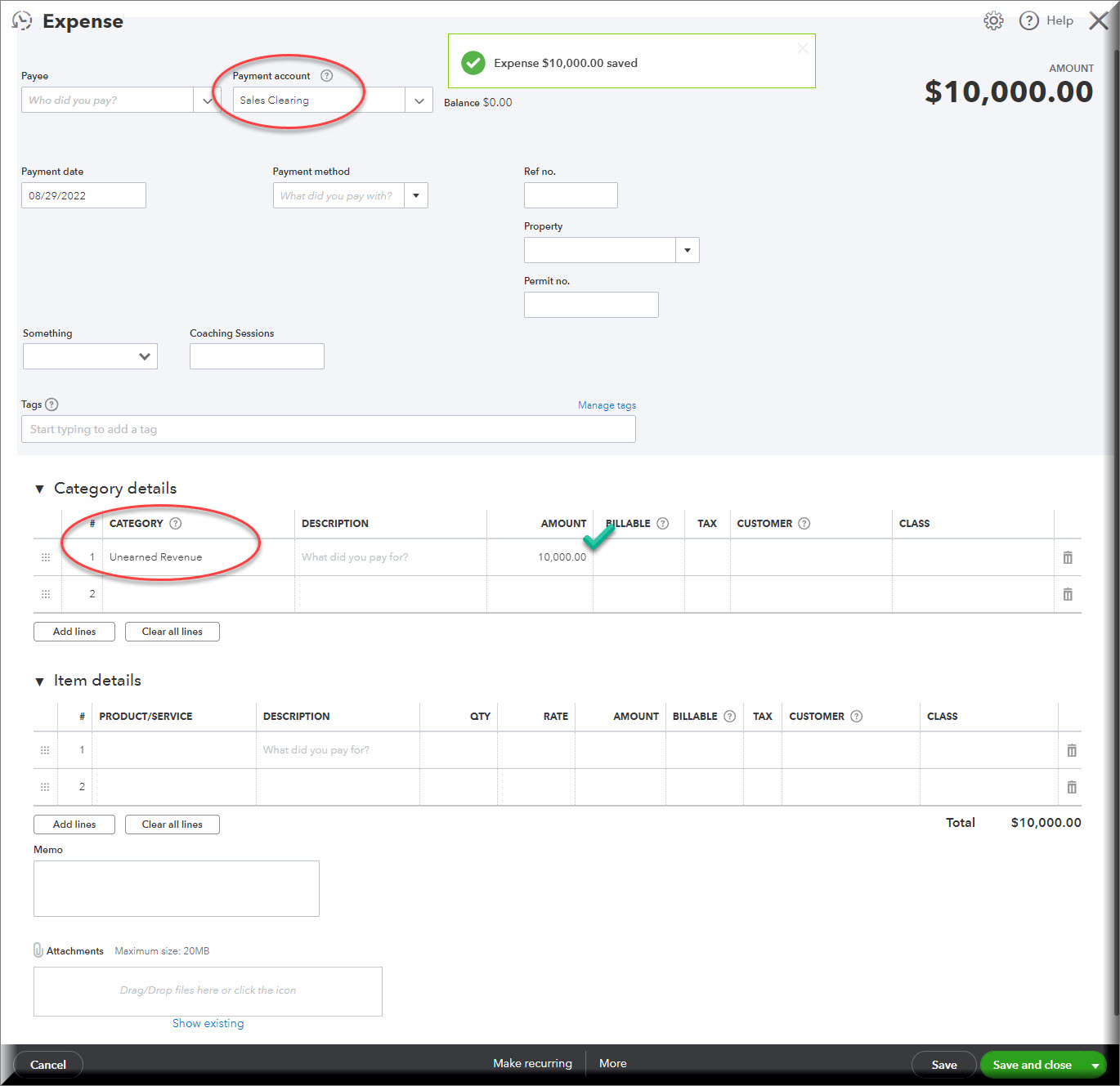

Instead of a journal entry we’re going to create an expense from Sales Clearing to Unearned Revenue:

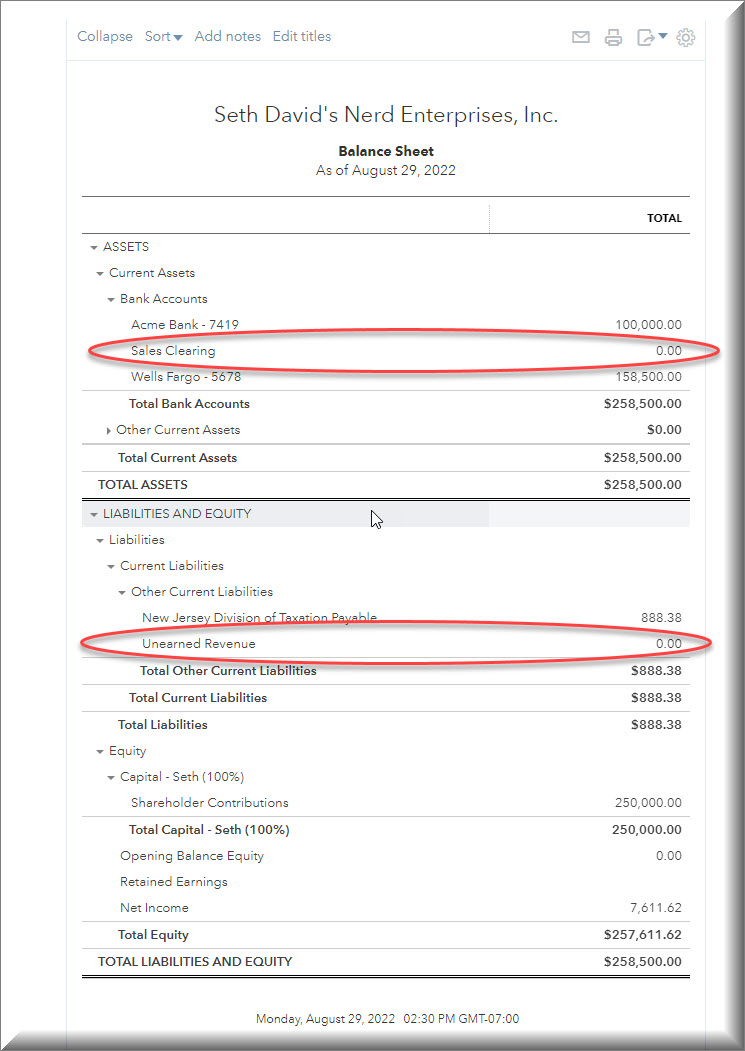

And of course if I refresh the Balance Sheet, everything is perfect in the world!

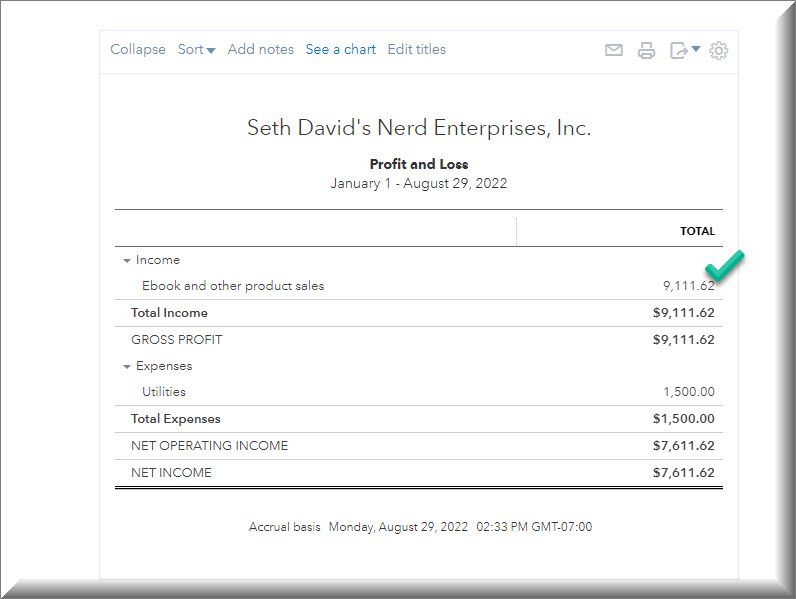

And here’s your profit and loss just for good measure:

Ultimately your state might get mad at you for paying late, but this does get them paid in the exact amount.

How to make this Bulletproof

Your records should include:

- A copy of that template you used to back into the sales

- A record of the sales receipts that add up to the $10,000 that was collected in total.

- A reconciliation of the funds collected and the $10,000 that was deposited into your bank account.

Keep all of this neatly filed in a Google Drive folder named for the Event so you will have an easy time of finding it in case you do get audited on this, so you can prove 100% of it.

READY FOR BLAST OFF?

Hop On 'Nerd's Guide to the Galaxy' and Experience the Ultimate in FREE Coaching, Resources and Training...

- Live workshops, trainings and recordings

- An intimate community of like-minded people

- A FREE course (and you choose your interest)

- Preferred access to my inner circle

- A Free subscription to my newsletter "Nerd's Words"

- Blog Post Notifications

- And MUCH MORE!

We hate SPAM. We will never sell your information, for any reason.