QuickBooks Online Classes vs Locations

Nov 01, 2022If you use QuickBooks Online then the question of Class vs Location is bound to come up at some point.

When I am asked by people, which one should I use? My answer is always both!

First let me show you where to go to turn these features on in the QuickBooks Online Settings.

Click the Gear Icon then click Account and Settings:

(click any image in this post for a closer look)

Then navigate to the Advanced settings and you’ll fine the “Categories” section:

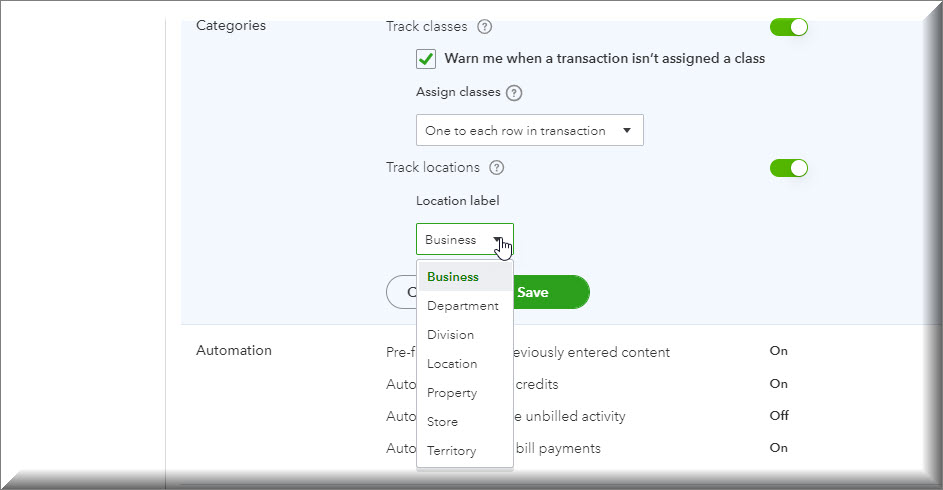

Turn both on and then note the additional settings for both Classes and Locations:

Under classes you have the option to track one to an entire transaction or one to each row.

Locations by contrast can only be tracked one to an entire transaction. This is an important distinction which I will get into further on.

Given that you don’t have the choice with Location, you almost ALWAYS want your classes set up for One to each row in a transaction.

When you click the Location Label drop down you immediately start to get ideas for how this can be used:

It would be amazing if we could add custom labels, but I am assuming its not that simple in the coding, or Intuit would have done this by now.

Locations

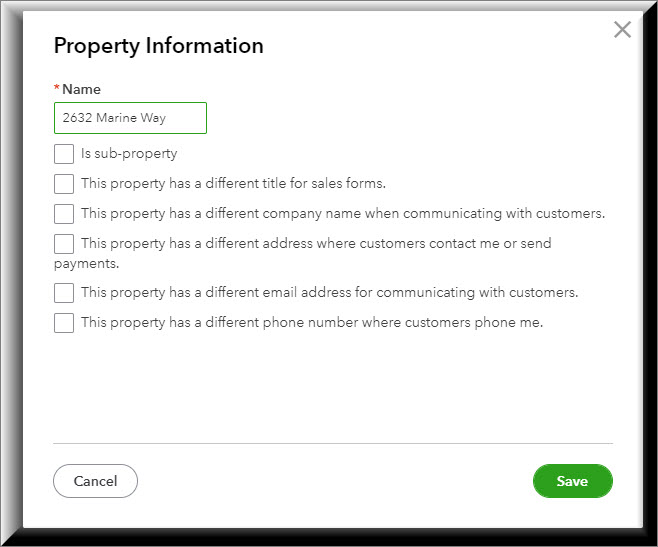

I’m going to set my Locations to “Property.”

Once you have QuickBooks Online Classes and Locations turned on, you can see how they show up in transactions. Let’s start by looking at an Expense Transaction.

Here’s an invoice:

As you can see, I can split a transaction to divide it up among different classes, but I can only use one location for the entire transaction.

So when I say that my answer to which one should you use is both, I am not kidding. If you don’t need to use them for different purposes, and sticking with the example of Properties, you can use both so that you can access different kinds of reporting for your properties.

Locations work better on the Balance Sheet and Classes work better on the Income Statement

Using both for your properties will enable you to get a really good “Balance Sheet by Location (Property)” and a really good “Profit and Loss by Class.”

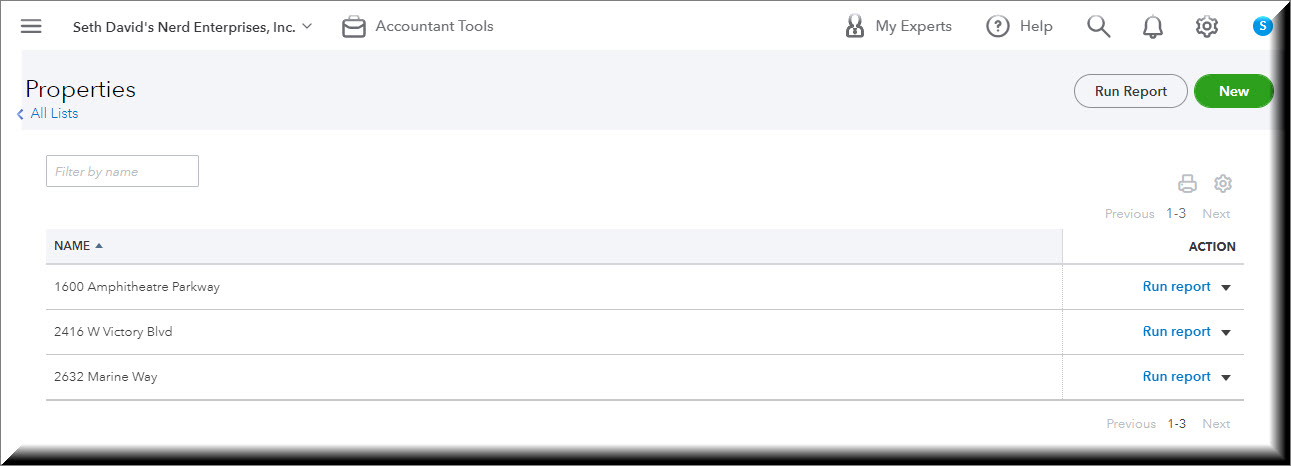

Let’s say you have 3 properties as follows:

- 2632 Marine Way

- 2416 W Victory Blvd

- 1600 Amphitheatre Parkway

Location in QuickBooks Online

We’ll set these up as Locations first. One of the really nice things about locations is each one can have it’s own contact info. So if you truly have divisions in your client’s company, you can use this and have separate invoice templates and contact information if you need to.

The “Properties” nomenclature updates based on what I chose in that drop down (see above).

Click through to that dialogue and click to add a new Property.

Note your options.

If you click any of those checkboxes a dialogue box will open up so you can enter the information.

I’ll add the other 2 locations now…

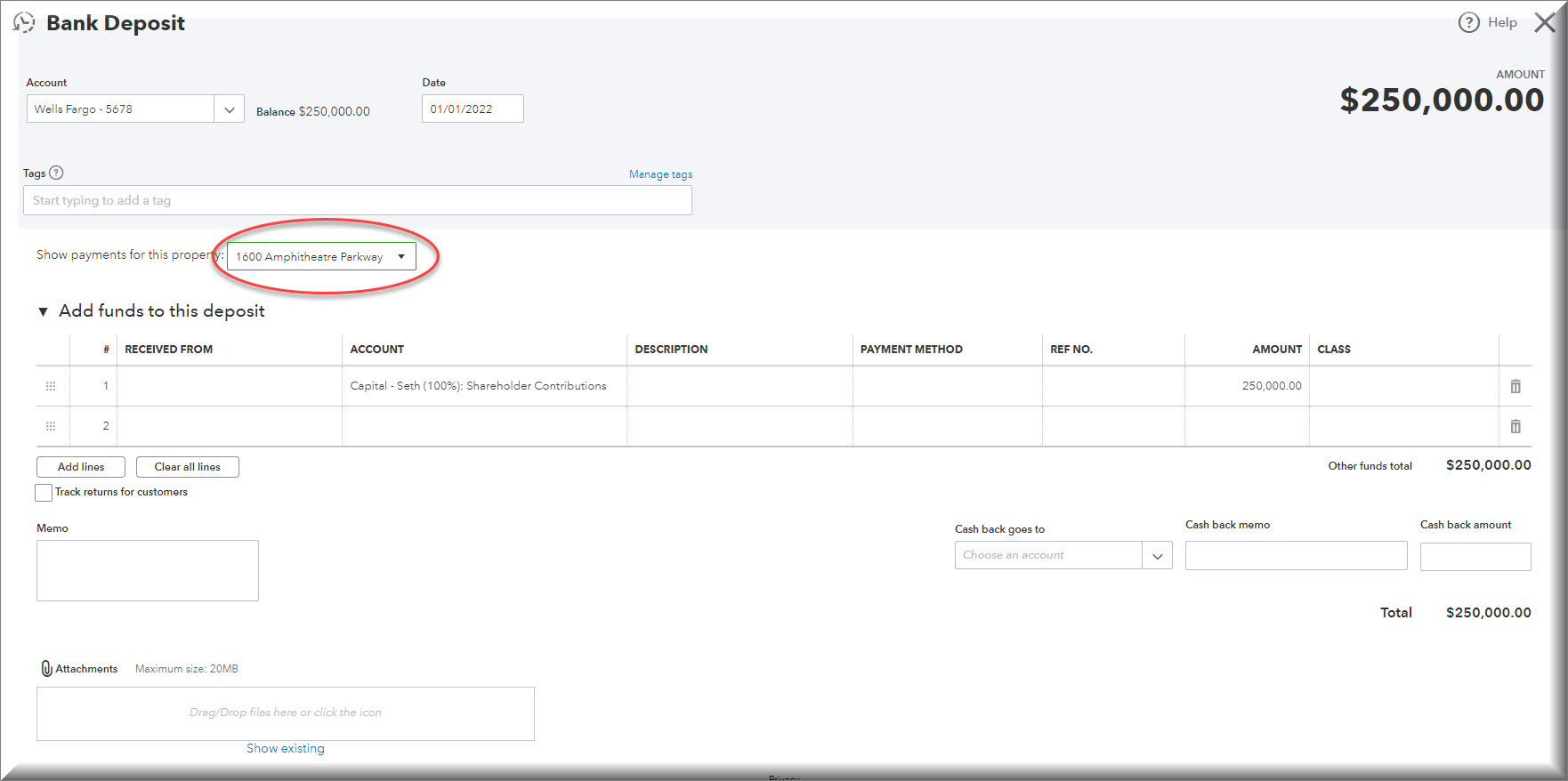

Now let’s say we deposited $250,000 into the bank account for our 1600 Amphitheatre Parkway property?

💡 Pro Tip:

Ideally you want to have a separate bank account for each property (location), but as you’ll see, you can still track it. This particular deposit is going to work perfectly on the Balance Sheet because it goes between 2 Balance Sheet accounts; the bank account itself and Shareholder Contributions (Equity).

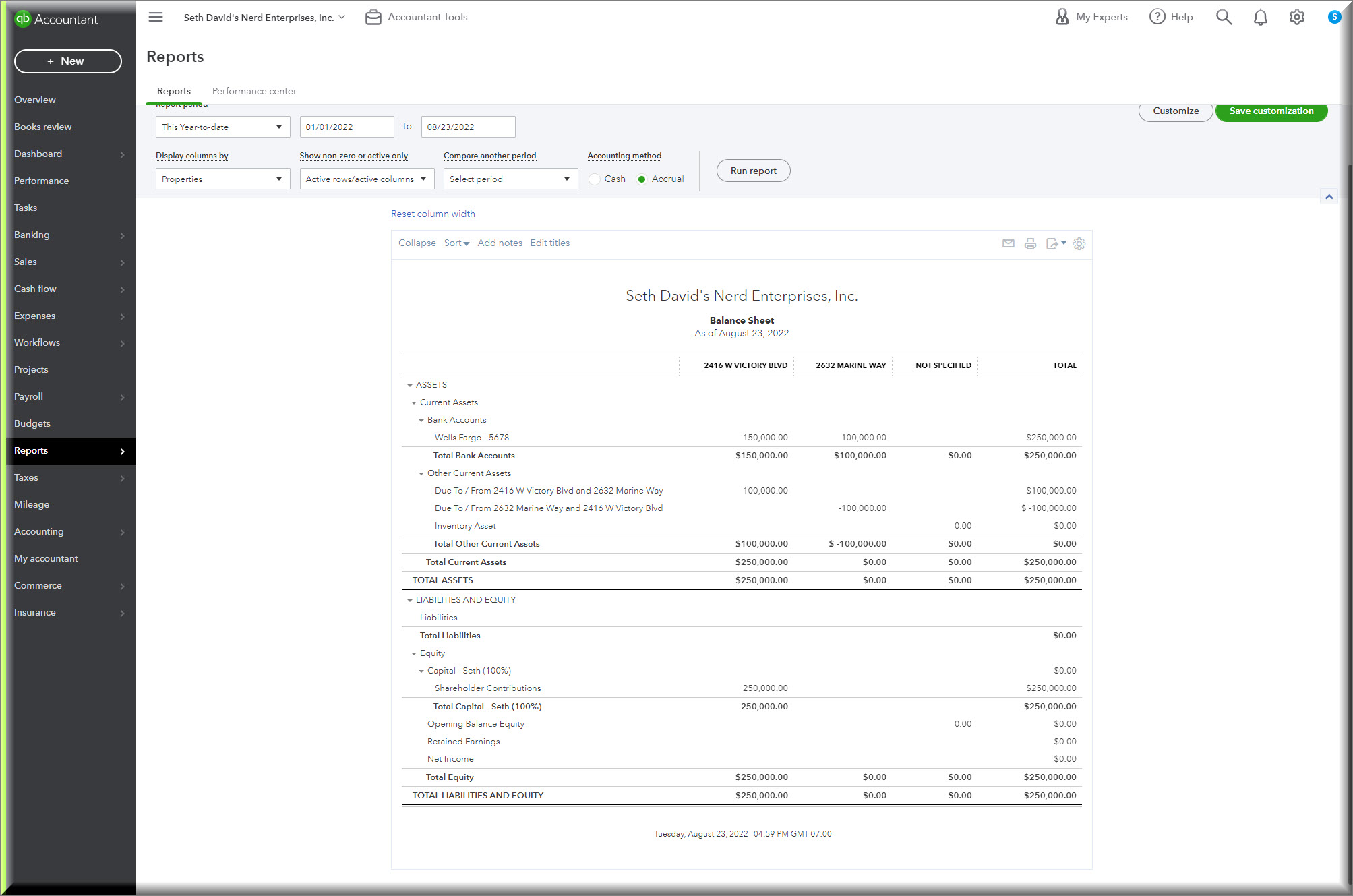

Once you record this deposit, you can run a Balance Sheet totaled by Property and it looks like this:

Now let’s say I want to loan $100,000 from 2416 W Victory Blvd to 2632 Marine Way.

If we’re sharing a bank account, then there is no transfer to be made. You can do this with a simple journal entry but we need to do 2 things:

- Show the money in the bank account divided between the 2 properties.

- Show the Due to / From accounts, but each property needs to have a separate Due To / From. If you use a single Due to / From account it will 0 out when you want to show that the one property now owes this money to the other.

The entry will go in and out of the same bank account, but with the different locations assigned as well as the 2 different due to / from accounts.

Journal entries are the one place where you can choose a Location aka Property on every line:

Let’s look at the Balance Sheet now, totaled by Property and this will make a ton of sense:

The money in the bank is divided perfectly between the two properties, and notice how nice this looks on the Due to / From accounts. It is crystal clear that 2632 Marine Way Owes $100K to 2416 W Victory Blvd.

Next I am going to delete that journal entry and we’re going to do this assuming that each property has it’s own bank account.

Wells Fargo - 5678 is 2416 W Victory Blvd’s account and

Acme Bank - 7419 is 2632 Marine Way’s account.

This is almost trickier, because the temptation will be to record a transfer between the two bank accounts but you can’t because you have to treat this as though it was between two completely separate companies with two different QuickBooks Online files.

So we’re going to record a payment from Wells Fargo - 5678 and book it to the Due To / From 2416 W Victory Blvd…

Then we’re going to record a deposit and book it to the Due To / From 2632 Marine way…

Attention to detail is really important.

Makes sure you have the right Bank Account, Property, and Due To / From account

So even though in the real world you may have just transferred the money between two bank accounts, in QuickBooks Online you have to record each side as a completely separate transaction.

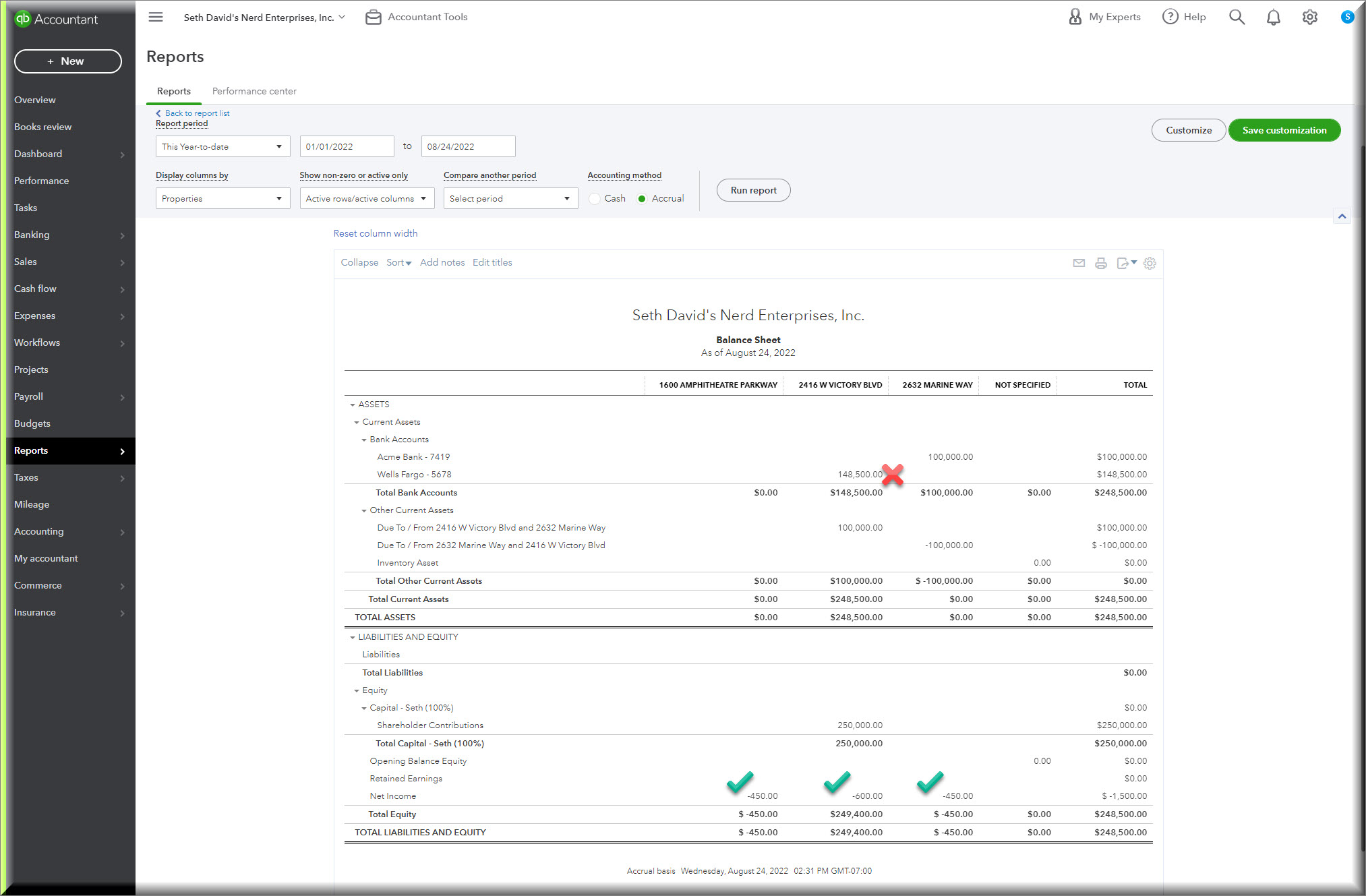

The balance sheet of course looks the same except for the extra bank account!

That should give you a pretty thorough idea of how Locations (called Properties in this case) work in QuickBooks Online. They work REALLY well on the balance sheet. Not so well on the profit and loss, because they don’t live at the transaction detail level, and that’s where your Income Statement accounts live.

Classes

Now let’s look at classes.

First I went through the same transactions and assigned the same properties in the form of classes, and then totaled the balance sheet by Class and you can see right away where classes fail

The bank account transactions don’t work on this report, even though the classes are assigned, and I haven’t even split the transactions to multiple classes.

The Due To From Accounts still work as you can see.

So classes work better on the Profit and Loss, and we’re going to assign both classes and properties on these transactions so we can see what works well and what doesn’t between classes and properties on the profit and loss report.

Let’s say I get one utility bill for all three properties and let’s say the split is 30/40/30 on a total bill of $1,500.00.

Now let’s look at a Profit and Loss by Class, then by property, then we’ll discuss:

Profit and Loss by Class

Profit and Loss by Property

You can already guess this isn’t going to work - everything will be associated with 2416 W Victory Blvd, but I will show you how you can fix that if you want to.

The way you can fix this is with a journal entry as follows:

Essentially you take $900 away from 2416 W victory to divide it up between the other two properties based on the split ratio. Now the Profit and Loss by Property works perfectly.

Of course this will be a lot of work if you have to book a journal entry every time you have a split like this.

Now let’s check the Balance Sheet 😉. Remember we wrote a check for $1,500 out of the Wells Fargo account with just the 1 property (2416 W Victory Blvd) assigned.

This won’t work well on the balance sheet as you’re about to see…

The $900 that we had to split up between the other two properties now needs to be shown in the Due To / From accounts. I did this both for Properties and Classes.

Now the balance sheet by Property is perfect, and the balance sheet by class has the same issue as before with the bank accounts, but everything else works.

You need a separate Due To / From every every combination of who loaned who money, and each one needs it’s own. If you look at how I structured and named them, the first property name in the title is always the one whose perspective you are seeing it form. In other words that’s the same property whose column you’ll find the amount in. This keeps it super clean and easy to follow.

The Balance Sheet by Property works perfectly, but as you can see it takes some work to keep this all straight.

Here’s the Balance Sheet by Class:

It’s almost perfect, except for the bank balances. There’s no fix for this. You would literally have to book a daily journal entry based on that day’s activity and heaven forbid you realize you left something out before you calculated and prepared the entries. Bottom line, don’t even think about it.

If you can spare the two lists; Location and Class for the same thing (Properties) then you can have the best of both worlds with a little redundancy.

You can run a profit and loss by class, and a Balance Sheet by Location (Property) and you have the best of both worlds. It will still require a fair bit of upkeep with the Due To / From activity.

The cleanest way is to have a separate bank account for each property, avoid having any property pay for anything on behalf of another. Keep it all separate, and that will keep it clean both on and off the books!

READY FOR BLAST OFF?

Hop On 'Nerd's Guide to the Galaxy' and Experience the Ultimate in FREE Coaching, Resources and Training...

- Live workshops, trainings and recordings

- An intimate community of like-minded people

- A FREE course (and you choose your interest)

- Preferred access to my inner circle

- A Free subscription to my newsletter "Nerd's Words"

- Blog Post Notifications

- And MUCH MORE!

We hate SPAM. We will never sell your information, for any reason.